illinois employer payroll tax calculator

An employee can use the calculator to compare net pay with different number of allowances marital status or income. Well do the math for youall you need to do is enter the.

How To Calculate Payroll Taxes Methods Examples More

That makes it relatively easy to predict the income tax you will have to.

. Ad Process Payroll Faster Easier With ADP Payroll. Calculate your taxable income Adjusted gross income Post-tax deductions Exemptions Taxable income understand your tax liability Taxable income Tax rate Tax liability minus. Discover ADP Payroll Benefits Insurance Time Talent HR More.

How to File Your Payroll Taxes. Enter the payroll information into Incfiles easy Employer Payroll Tax Calculator. Ad Start Afresh in 2022.

Withhold 62 of each employees taxable wages until they earn gross pay of 142800 in a given calendar year. An employer can use the calculator to compute and prepare paychecks. Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes.

This offers stability and convenience. You exceed 12000 in withholding during a quarter it is your responsibility to begin to pay your Illinois withholding income tax semi-weekly in the following quarter the remainder of the year. Ad Payroll So Easy You Can Set It Up Run It Yourself.

Processing Illinois payroll taxes for your hourly employees in an accurate and timely manner is crucial. The IL Tax Calculator calculates Federal Taxes where applicable Medicare Pensions Plans FICA Etc allow for single joint. Just enter in the.

The Illinois tax calculator is updated for the 202223 tax year. Ad Process Payroll Faster Easier With ADP Payroll. Online - Employers can register through the.

Enter the amount figured in Step 1 above as the total taxable wages on line 1a of the withholding worksheet that you use to figure federal income tax withholding. What Are Employer Unemployment Insurance Contribution Tax Rates. No Need to Transfer Your Old Payroll Data into the New Year.

The state of Illinois has a flat income tax which means that everyone regardless of income is taxed at the same rate. The standard FUTA tax rate is 6 so your max. Federal tax rates like income tax Social Security 62 each for both employer and employee and Medicare 145 each plus an additional 09 withheld from the wages of an.

Doing so will ensure your business runs. Employers can fill the information in a paystub generator Illinois about their company such as employees information and payment details. Illinois payroll calculators Latest insights The Prairie State has a flat income tax system where the income taxes are relatively low compared to the rest of the country.

Illinois Salary Calculator for 2022 The Illinois Salary Calculator is a good calculator for calculating your total salary deductions each year this includes Federal Income Tax Rates and. Number of Qualifying Children under Age 17. Choose Marital Status Single or Dual Income Married Married one income Head of Household.

Get Started With ADP Payroll. Discover ADP Payroll Benefits Insurance Time Talent HR More. State Experience Factor Employers UI Contribution Rates - EA-50 Report for 2017 EA-50 Report for 2018 EA-50.

Calculate your Illinois net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into this free Illinois paycheck. The Bottom Line On Illinois Hourly Payroll Tax. The maximum an employee will pay in 2021 is 885360.

Compare Side-by-Side the Best Payroll Service for Your Business. Newly-created businesses employing units must register with IDES within 30 days of start-up. Salary Paycheck Calculator Illinois Paycheck Calculator Use ADPs Illinois Paycheck Calculator to calculate net take home pay for either hourly or salary employment.

Prepare your FICA taxes Medicare and Social Security monthly or semi. Taxes Paid Filed - 100 Guarantee. Get Started With ADP Payroll.

FUTAs maximum taxable earnings whats called a wage base is 7000 anything an employee earns beyond that amount isnt taxed. Get Started for Free. Occupational Disability and Occupational Death Benefits are non-taxable.

Use Gustos salary paycheck calculator to determine withholdings and calculate take-home pay for your salaried employees in Illinois. This calculator is a tool to estimate how much federal income tax will be withheld from your gross monthly check. Check if you have multiple jobs.

Illinois Payroll Tools Tax Rates And Resources Paycheckcity

/FormW-42022-310142d4de9449bbb48dd89327589ace.jpeg)

W 4 Form How To Fill It Out In 2022

Istudy Bookkeeping And Payroll Services Are Common In Eve Payroll Accounting Payroll Bookkeeping

Free Employer Payroll Calculator And 2022 Tax Rates Onpay

How To Calculate Payroll Taxes Methods Examples More

Income Taxes Preparing A U S Tax Form With Money In Mind Sponsored Preparing Taxes Income Tax Mind Ad Income Tax Tax Refund Tax Services

Illinois Paycheck Calculator Smartasset

Epf Member Passbook For Tax Calculation Passbook Flow Chart Hobbies To Try

Free Employment Contract Template Pdf 7 Page S Contract Template Construction Contract Contract

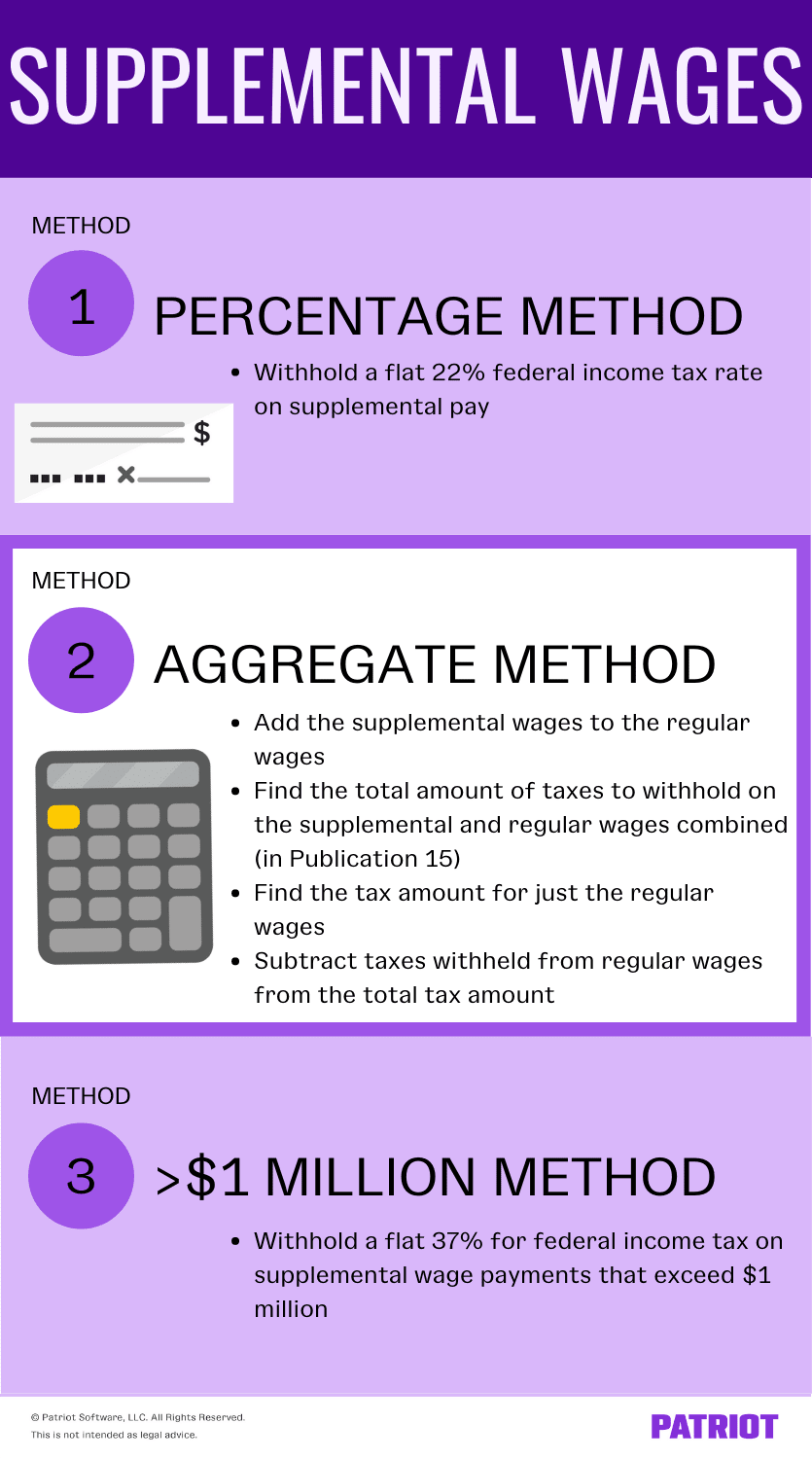

Supplemental Wages Definition And Tax Withholding Rules

What Are Employer Taxes And Employee Taxes Gusto

Capital Gains Tax What Is It When Do You Pay It

Aflac Supplemental Insurance Information Aflac Insurance Life

What Are Employer Taxes And Employee Taxes Gusto

Illinois Payroll Tools Tax Rates And Resources Paycheckcity

/FormW-42022-310142d4de9449bbb48dd89327589ace.jpeg)